Fed's Beige Book: Tariff uncertainty raising costs in US

Pervasive uncertainty due to tariffs is increasing costs for US businesses and consumers, leading to a rush to buy inventory and a gloomy outlook for the future, according to the Fed's first economic survey since late February, when President Donald Trump began imposing duties on other countries.

The US Federal Reserve on Wednesday released its latest edition of the Beige Book to summarize economic conditions and prospects based on a variety of mostly qualitative information, gathered directly from its 12 regional districts.

The April 2025 report, based on surveys conducted since February, noted that "uncertainty around international trade policy was pervasive across reports", contributing to a weakening economic outlook and dampened business confidence nationwide.

It said that the "outlook in several Districts worsened considerably as economic uncertainty, particularly surrounding tariffs, rose".

The findings echoed the gloomy forecast of the International Monetary Fund, which cut the US economic growth projection for this year by 0.9 percentage point from its January forecast, with nearly half of that downgrade directly attributable to new tariffs.

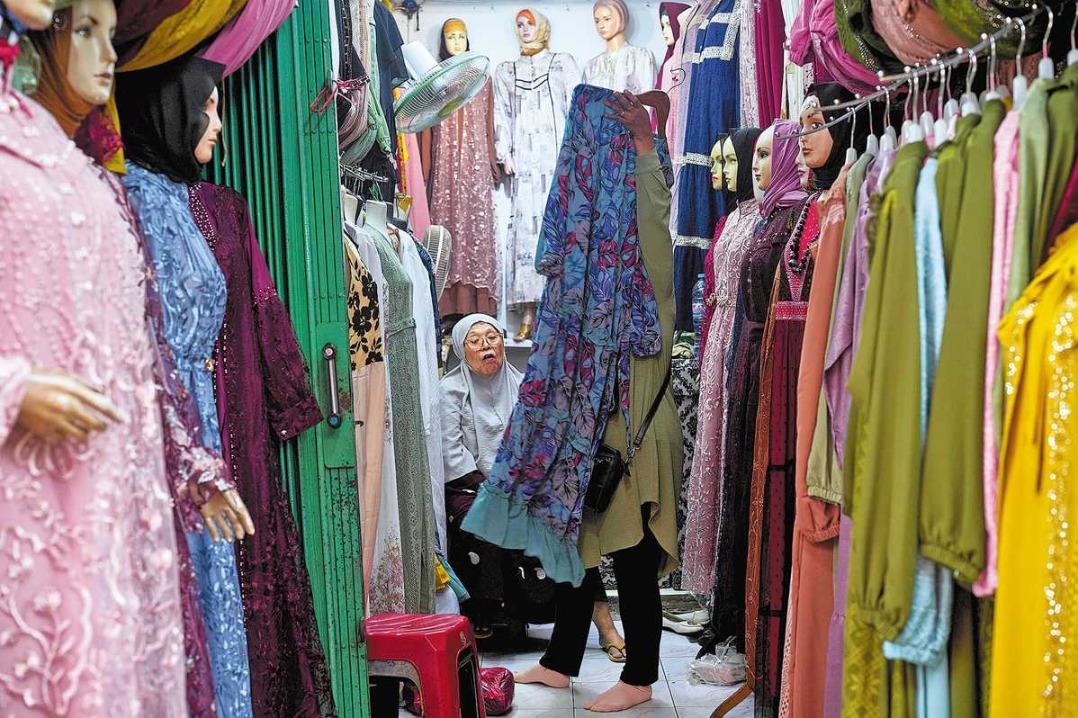

The looming threat of new tariffs has already begun to alter consumer behavior and business operations.

A common theme throughout the Fed report is a "rush to purchase ahead of tariff-related price increases", particularly evident in vehicle and nondurable goods sales.

For example, in reporting ports and transportation activities, the Fed's Richmond District noted that "imports for autos and some retail goods increased as orders were placed to get ahead of potential tariffs", while loaded exports were down significantly, with one port noting an "unexpected and disappointing" 25 percent decline month over month.

"Port contacts were particularly concerned about the proposed port call tax on Chinese vessels which, by their estimates, could quadruple cargo handling costs," it said.

Some ports received multi-million-dollar tariff bills on Chinese cranes that were already ordered and en route as tariffs were enacted and are now subject to the tariff, it added.

However, the short-term boost in purchasing was not enough to offset a broader pullback in consumer spending and investment, as "most Districts saw lower non-auto consumer spending".

Business leaders across sectors cited elevated input costs, supplier notices of price hikes and "firms reported adding tariff surcharges or shortening pricing horizons to account for uncertain trade policy", according to the Beige Book.

In the Fed's New York District, economic activity contracted modestly, as heightened uncertainty weighed on businesses and consumers.

"Businesses expressed significant concern about tariffs. Outlook darkened, with many businesses anticipating declining activity and rising prices," the New York Fed said.

This was also the case in the Kansas City District, where expectations about business activity and consumer spending weakened considerably, and prospects of price growth rose at a robust rate, most pronounced in goods sectors.

In the manufacturing sector, often at the front line of trade tensions, conditions were described as "mixed", with two-thirds of Districts indicating either stagnant or declining activity, and several Districts seeing a deterioration in demand for non-financial services, according to the Beige Book.

The Beige Book is published eight times a year.

On Wednesday, a coalition of 12 states filed a lawsuit against the Trump administration, alleging that recent tariffs constitute unauthorized tax increases on Americans.

"Congress has not granted the president the authority to impose these tariffs and therefore the administration violated the law by imposing them through executive orders, social media posts, and agency orders," New York Attorney General Letitia James' office said in a statement.

In a statement, White House spokesperson Kush Desai called the legal action a "witch hunt".

Also on Wednesday, US Treasury Secretary Scott Bessent said that he believes that excessively high tariffs between the US and China will have to come down before trade negotiations can proceed, Reuters reported.

Ryan Petersen, CEO of digital freight forwarder Flexport, took to X on Wednesday to issue stark warnings about the tariffs' impact on industry. "In the 3 weeks since the tariffs took effect, ocean container bookings from China to the United States are down over 60% industry wide," he wrote.

If the tariffs on China continue at this level, the US will see "a $2T hit to economic activity in our country, the failure of tens of thousands of American businesses, and the laying off of millions of employees," Petersen wrote.