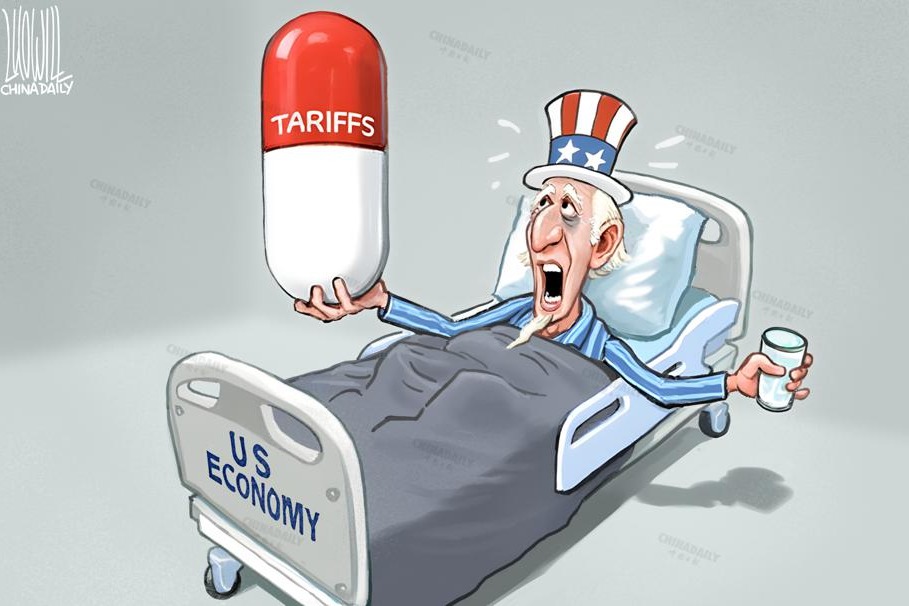

US tariffs can boost China-ASEAN trade

President Xi Jinping's visit to Vietnam, Malaysia and Cambodia comes at a time when China and most of the Southeast Asian region are working on strategies to offset the impacts of a new round of high tariffs by the United States on their imports.

Apart from China, which has traditionally been the largest source of imports for the US, most Southeast Asian countries are major exporters to the US. With the US administration deciding to "correct the goods trade imbalances" that the US has with its trade partners, the economies that have large trade surpluses with the US have been hit with the highest tariffs.

Currently, the US has announced accumulated tariffs of 245 percent on Chinese imports. Also, after the US announced the imposition of reciprocal tariffs on April 2, the tariffs on exports from several US trade partners have increased significantly. Among Southeast Asian countries, Cambodia has attracted the highest tariff hike — 49 percent — followed by Laos, Vietnam and Myanmar, with tariffs of 48 percent, 46 percent and 44 percent respectively. Malaysian goods, meanwhile, face 24 percent tariffs.

Although the US administration has delayed most of the tariffs by 90 days, a baseline tariff of 10 percent has been levied since the announcement of the reciprocal tariffs on practically all US trade partners, including the countries mentioned above. Further higher tariffs on specific countries will come into effect after 90 days.

In the intervening period, countries are expected to individually negotiate with the US on a variety of mutual tariff and non-tariff market access barriers. The success of these negotiations will determine the eventual country-specific tariffs.

Since the beginning of the United States' trade war against China in 2018, Southeast Asia has attracted considerable attention, because of the shifting of a number of investment projects and parts of industry and supply chains from the Chinese mainland to various Southeast Asian countries. The relocation was due to the producers wanting to export goods to the US from locations that didn't attract the kind of tariffs that products from China did.

Vietnam, Cambodia, Laos, Malaysia, Thailand and Indonesia are important countries in this regard. Exports from these countries have been getting entry into the US at low MFN (most-favored-nation) tariffs that are about 2.5 percent on most items. In addition, some of these countries have also been enjoying preferential market access through the US Generalized System of Preferences.

However, the new set of tariffs will significantly impact the access exports from these countries will get to the US market. Therefore, these countries need to identify new markets and diversify their exports.

Reciprocal tariffs introduced by the US are likely to have the wider impact of encouraging more trade diversion from the US market. This is expected to develop into a US plus one strategy. In this respect, the main exporters from Southeast Asia to the US, such as Vietnam, Thailand and Indonesia, will look to export more to China.

As the world's second-largest economy, China is the most important regional market that Southeast Asian economies will look forward to diversifying their exports. This intention also complements China's efforts to boost domestic consumption, particularly those of imports.

Increasing imports from Southeast Asia, particularly through existing trade agreements, such as the Regional Comprehensive Economic Partnership and the China-ASEAN Free Trade Agreement, should be economically beneficial for China.

Having access to more inexpensive imports from the region that will meet both its consumption and intermediate input requirements can help China shift more of its domestic production to high-tech areas. More imports from the region will also help support the large online retail market in the country that can source more goods from the region and offer a wider variety to domestic customers.

These prospects will also encourage Chinese businesses to expand their capacities in Southeast Asia with an eye to making products for the mainland market.

The current volatility in world trade caused by the US tariffs will lead to the realignment of global production networks, the functioning of supply chains and cross-border patterns of regional trade. It is quite likely that one of the most prominent shifts could be increased trade between China and Southeast Asia with several Southeast Asian countries becoming major exporters to China, and Chinese investment further increasing in the region. President Xi's visit to Southeast Asia and his meetings with regional leaders could mark the beginning of this new transition.

The author is a senior research fellow and research lead (trade and economics) at the Institute of South Asian Studies, National University of Singapore. The views don't necessarily reflect those of China Daily.

If you have a specific expertise, or would like to share your thought about our stories, then send us your writings at [email protected], and [email protected].