Fishing for chips

Chinese smartphone makers realize processor supplies are key to achieving global supremacy

In the $429 billion global smartphone market, dominance in the domestic and Indian segments may encourage Chinese handset makers to dream of ejecting Apple and Samsung from the pinnacle, but the reality is far removed.Chinese vendors still have several loose ends to tie up, none starker than their poor control over key sections of the supply chain, particularly chips, or processors, the engines that drive the handset hardware -the brain, if you will.

This painful truth came to torment Huawei Technologies Co Ltd, the current leader of the Chinese smartphone pack, recently.

All hell broke loose when Richard Yu, CEO of its consumer business unit, admitted in his Weibo post last month that shortage of top-end chips forced Huawei to use a mix of relatively less efficient flash memory cards and high-performance universal flash storage or UFS cards in its flagship P10 smartphone.

The UFS chip is faster than a typical flash memory card, and is essential for high-resolution games and movies.

Yu stressed the P10 hardware cocktail was not meant to save money but ensure a steady supply of shipments and timely delivery of orders.

But irate consumers bombarded Huawei with complaints.

Two red flags went up immediately.

One, anything that undermines a chip is a strict no-no.

Two, Huawei's marketing campaign for the P10 high-lighted a chip-related specification as one of the stand-out features, which stood negated by the company's late admission of truth.

"The (Huawei P10) incident is the latest example of Chinese smartphone vendors' overreliance on foreign chips. This factor has subjected their delivery schedule to the influence of supply chain partners," said Xiang Ligang, a telecom expert and CEO of cctime.com, a telecom industry website.

Agreed Jia Mo, an analyst at Canalysys. "The Huawei incident mirrors a broad problem in China's burgeoning electronics sector. Though China is a manufacturing powerhouse in computers, smartphones and other electronic gadgets, the country banks on foreign players for most processors."

Stated differently, Chinese smartphone manufacturers are years away from self-reliance in, and mastery of, chip-making,which is currently the preserve of global majors such as US multinational Qualcomm, and South Korea's Samsung and SK Hynix.

Qualcomm Inc is the undisputed leader of the global mobile processor market -this is borne out by the fact that all the seven Chinese brands among the world's top 10 smartphone labels depend on it for chips, especially in the premium segment.

It's a truth that does not sit well with the fact that China's smartphone giants have posted exponential growth in both home and overseas markets in 2016.

Domestic shipments for the country's top three vendors Huawei, Oppo and Vivo touched 224.2 million units, up more than 80 percent year-on-year, while their overseas shipments reached 91.8 million units, up about 70 percent year-on-year. Together, they accounted for 21.6 percent of the global smartphone shipments in 2016, according to data compiled from IDC.

But that may count for nothing eventually without reliable supplies of top-end chips, the key to successful forays into, and dominance of, the premium smartphone segment.

Dominance in the premium smartphone segment has strategic significance because it not only indicates technological prowess but generates massive profits.

For instance, in the first quarter of this year, Apple's iconic top-end iPhones, which are powered by in house chips, earned $10.1 billion, or 83.4 percent of profits of the global smartphone segment, according to Strategy Analytics, a market research firm.

So, having the ability to make top-end chips will likely also help Chinese companies to better manage other supply chain partners, experts and company executives said.

In this context, Samsung appears to have an edge as it makes, besides handsets, its own chips, which it also supplies to competitors, including those from China.

That's not all. Samsung and SK Hynix also control nearly half the global market for NAND flash memory, a key component in the UFS chip. Both of them warned last month chip supplies will remain tight this year due to production bottlenecks and strong demand from high-end smartphone makers.

Part of that demand can be traced to China.

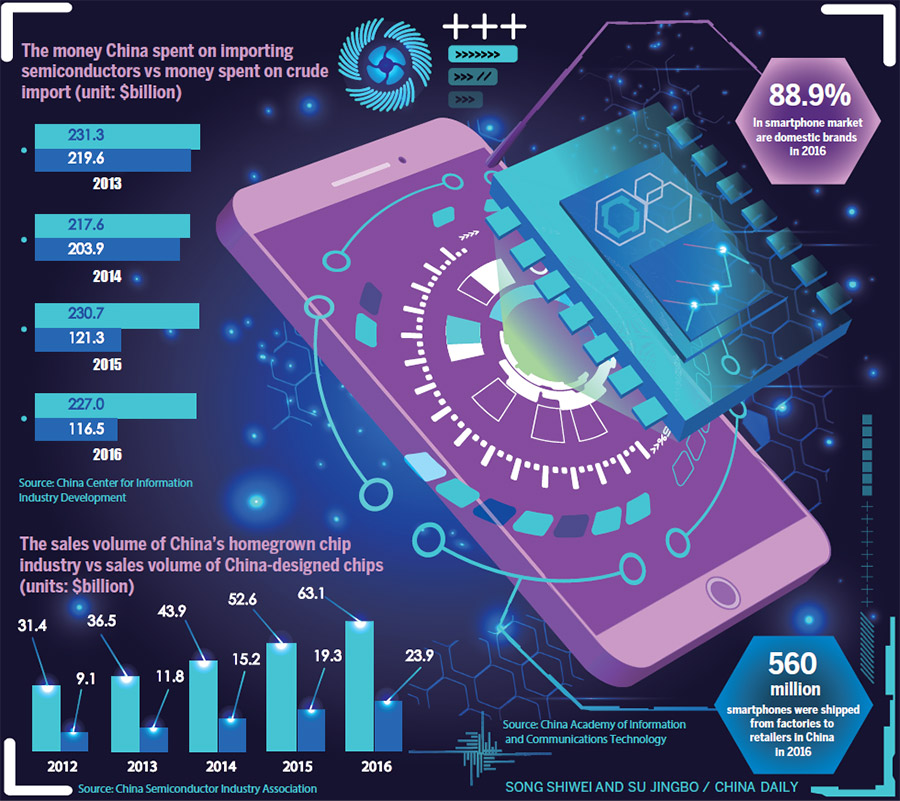

According to the General Administration of Customs, in 2016, the country imported chips worth $227 billion, nearly double the $116.5 billion it spent on crude oil imports.

In comparison, the homegrown chip industry's 2016 sales were worth just $63.1 billion, including $23.9 billion from sales of chips designed in China, according to China Semiconductor Industry Association data.

Chip design is considered the most sophisticated aspect of the industry. "Most flagship handsets use Qualcomm's processors. But its production capacity in high-end chips is limited. These chips required cutting-edge manufacturing techniques, which need time to mature. The initial investment size is often conservative,"Mo of Canalysys said.

"If the majority of Qualcomm's Snapdragon 835 processors go to Samsung, Chinese players such as Xiaomi would suffer from supply shortage and have no other choice but to delay their product launches."

The situation is unlikely to improve any time soon.

For, Chinese smartphone vendors are itching to compete in the high-end market. So, chip shortages will likely get more acute, experts said.

To be fair, Chinese labels such as Xiaomi and Huawei did anticipate this problem and made efforts to develop their own alternatives. For instance, Xiaomi unveiled its first in-house chip in March.

Way back in 2004, Huawei started its research and development of chips. It can now supply a number of mobile processors for its high-end devices, though it still leans a bit on Qualcomm for the "system on a chip" technology.

Chinese chip maker Tsinghua Unigroup is working on a $30 billion domestic memory chip production complex in Nanjing, Jiangsu province. But it is still several years away before the plant begins to produce chips.

Roger Sheng, a senior chip analyst at research firm Gartner Inc, said: "In-house design and manufacture of chips for specific devices would help deliver differentiated product performance. It can also boost smartphone vendors' bargaining power with suppliers.

"But heavy resources need to be poured into the (chip) segment. Each smartphone maker's annual shipments need to reach 10 million units to cover the cost of developing tailor-made chips.

"It's a risky business. Missteps would add weeks to the product launch schedule. Money alone won't guarantee success. But it's a path that Chinese players have to take if they want to rise to supremacy in the high-end market."