On a dark road without headlights

The dollar hegemony, the 'safety cable' of the US economy, is increasingly being eroded under the tariff blitz of the US government

Editor's note: The world has undergone many changes and shocks in recent years. Enhanced dialogue between scholars from China and overseas is needed to build mutual understanding on many problems the world faces. For this purpose, the China Watch Institute of China Daily and the National Institute for Global Strategy, Chinese Academy of Social Sciences, jointly present this special column: The Global Strategic Dialogue, in which experts from China and abroad will offer insightful views, analysis and fresh perspectives on long-term strategic issues of global importance.

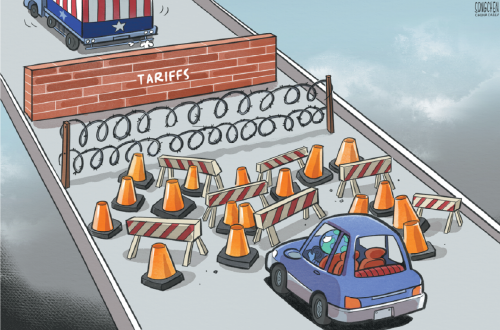

What the United States is doing has almost no historical precedent. The US' endless back-and-forth on tariffs makes any accurate forecast of what lies ahead nearly impossible.

But one thing is certain: it's nothing good.

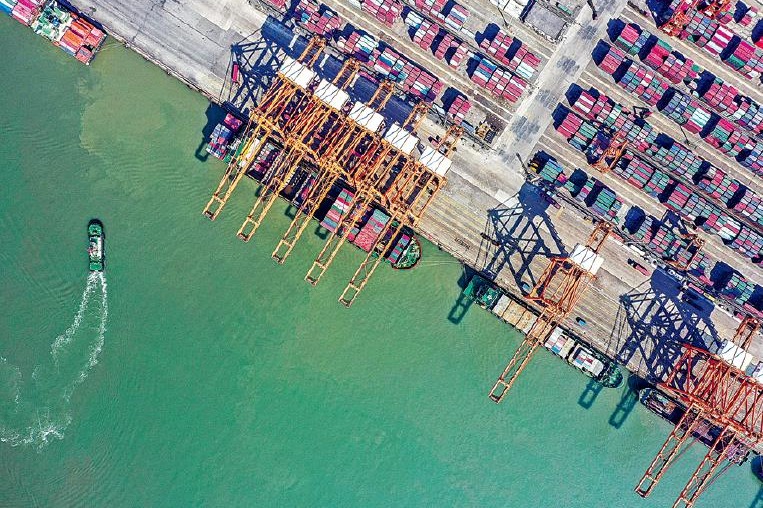

Even in an "optimistic" — perhaps naive — scenario where the "tariff war" remains largely confined to a bilateral clash between China and the US, the outlook is grim. After all, this would be a conflict between the world's two largest economies.

But, it seems unlikely that the phenomenon unleashed by the US government will remain limited to a bilateral dispute with China — even though the growing rivalry with the Asian giant lies at the heart of the US' geopolitical and geoeconomic concerns.

Behind the simplistic, clumsy and outright false logic of the "tariff blitz" is the US administration's palpable anxiety about the US' place in the new world order.

If the US faces increasing difficulty maintaining its hegemony, disrupting the international political order and the smooth functioning of the global economy — already fraying — might offer it some strategic utility, however questionable. This is especially true given the US' mounting debt.

Currently, US public debt stands at 120 percent of GDP — approximately $36 trillion. The last budget surplus occurred in 2001, and the last trade surplus was in 1975.

China reduced its exposure to US debt in December 2024, bringing its reserves down to around $759 billion — significantly below the peak of $1.3 trillion a decade ago. This diversification strategy is complemented by China's gold reserves, reaching 2,284.55 metric tons by the end of January.

The US administration, with its erratic and improvised response to this immense strategic challenge, fuels uncertainty about the stability and predictability of US economic policy — further eroding the cornerstone of US geopolitical power: the dollar's status as the world's primary reserve currency and preferred medium for global trade.

Although the renminbi's share in global financial transactions (3.75 percent as of December 2024) remains far behind the dollar's dominance (49 percent in the same period), there is a growing trend toward dollar substitution — not just by the renminbi but also by other currencies in regional and bilateral trade.

This trend has been accelerated by the political weaponization of the dollar through sanctions against countries such as Russia, Venezuela and Iran, which has undermined trust in the US currency.

Of course, addressing the current account deficit with a simplistic analysis — focusing only on the goods trade while ignoring services and income flows — is doomed to fail.

The US government claims these measures will spur new US investments, but this seems unrealistic given the instability already unleashed in domestic and global markets. The combination of unpredictable policies and rudimentary economic calculations will likely produce the opposite of the promised results.

It's worth noting that reducing the deficit and revitalizing US industry are not inherently irrational goals. The problem lies in the total absence of a rational — or even lawful — strategy within the multilateral trade rules largely shaped by the US to achieve these objectives through long-term negotiations without destroying regional and global value chains.

No one rebuilds an industry overnight through improvised, extreme protectionism. What we'll witness are supply chain disruptions, shortages and inflationary pressures — because there was no preparation or maturation time in logistics and infrastructure. This entire process is marked by improvisation and inconsistency.

A well-designed industrial policy — focused on building long-term national and regional value chains within agreed multilateral rules, as Brazil is attempting under President Luiz Inácio Lula da Silva's third administration — would be necessary.

China did not become the world's second-largest economy and the planet's factory by practicing crude protectionism or "taking advantage of the US".

China became what it is today by rejecting the neoliberal paradigm that the US helped impose on the world — and, to some extent, on itself. Indeed, China's rise resulted from a complex, well-crafted economic, political and technological strategy — not bluster and threats.

As early as 2005, the Chinese government elevated indigenous innovation to a national strategic priority. Over the following two decades, China not only consolidated its position in existing value chains but also made a qualitative leap in its industrial base — expanding its productive complexity and gaining competitive advantages in strategic sectors, from renewable energy to aerospace and microelectronics.

As a developing country, China has long placed strong emphasis on research and development, technological innovation, industrial-scale investments and its remarkable ability to transform applied research into commercial solutions, which suggest that technological parity with early leaders is not only possible but may be achieved soon. This trajectory challenges the conventional notion that technological advantages are structurally irreversible, pointing toward a more dynamic global competition landscape.

But the key issue here is not the US' fundamental mistake of reacting to major geoeconomic and geopolitical shifts with improvised, counterproductive measures. The core issue is geopolitical. With reckless unilateralism, the US has destroyed the old "rules-based world order" and is trying to impose, by force and threats, a new "Hobbesian" world order — one that would recreate the unchallenged, unilateral US hegemony that prevailed from the Soviet Union's collapse through the first decade of this century.

How will the world withstand this "stress test" imposed by the planet's great power?

"Salvation" may lie in a grand international concert — one that illuminates another road, leading to the fight against global asymmetries, climate balance, international cooperation, peace and a renewed world order based on fair rules, an order built on the understanding that international relations need not be a zero-sum game.

The author is president of the Brazilian Development Bank, former Brazilian minister of education, and former Brazilian minister of science, technology and innovation. The author contributed this article to China Watch, a think tank powered by China Daily. The views do not necessarily reflect those of China Daily.

Contact the editor at [email protected].