Latin American economies shun unipolar system with RMB's internationalization

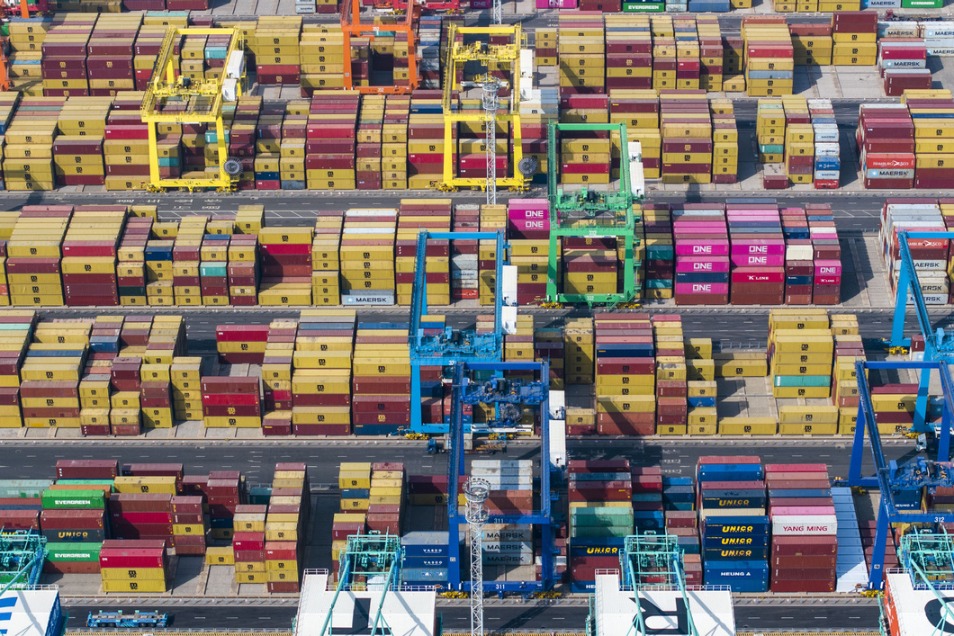

The currency-swap agreement between China and Argentina must be among the major achievements of China-Latin America financial cooperation. First signed in 2009, it was the first of its kind between China and a Latin American country.

For Argentina, the deal came as a crucial financial lifeline, reinforcing its foreign reserves and enhancing its ability to meet international debt obligations, including those to the International Monetary Fund. The swap agreement enables the country's central bank to access renminbi that can be converted into dollars, bolstering foreign reserves and, by extension, the Argentine government's ability to repay creditors including the IMF.

Over the past 16 years, this mutually beneficial agreement has been renewed multiple times, with the latest extension in June 2024 securing a 35 billion yuan ($4.76 billion) swap line. For Argentina, which is grappling with severe economic instability, the deal has eased short-term repayment pressures and provided much-needed fiscal flexibility.

For China, it represents a strategic step in the RMB's internationalization, particularly in filling a gap in Latin America. For Argentina, the world's leading exporter of agricultural products, the swap agreement strengthens trade ties with China, ensuring smooth transactions for key exports such as soybeans and beef. This benefits Chinese consumers by ensuring stable access to high-quality food imports.

These developments reflect China's foreign cooperation principles: no political strings attached, no targeting of third parties. As Lin Jian, spokesperson for China's Foreign Ministry, stated at a recent news conference: "China's bilateral cooperation with relevant countries never targets any third party, nor should it be interfered with by any third party."

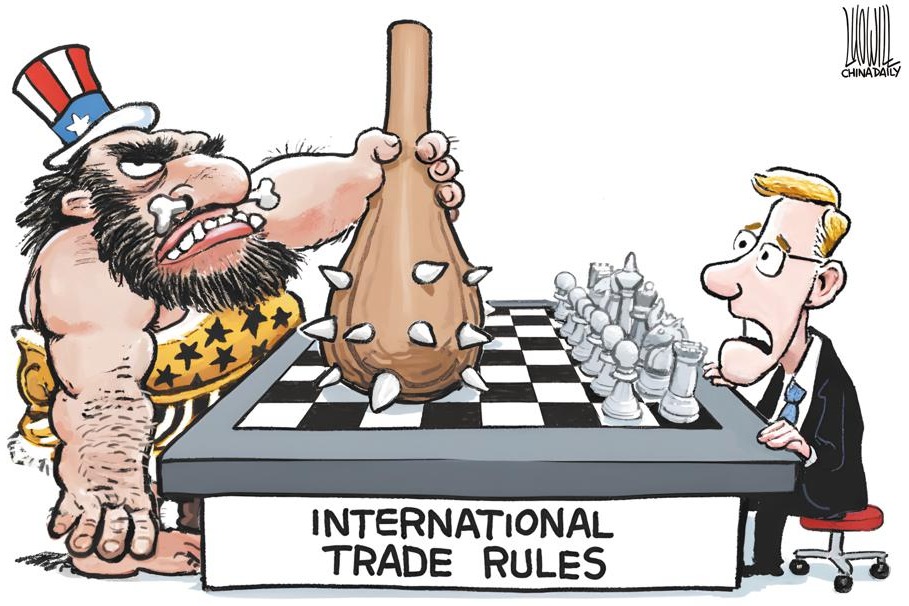

In stark contrast, the US has repeatedly attempted to undermine Sino-Latin American financial agreements. Mauricio Claver-Carone, the US president's special envoy for Latin America, falsely labeled the China-Argentina swap agreement as "extortionate", claiming that "China will always be able to extort Argentina". This accusation is baseless exposing the US' real agenda: to block China's cooperation with Latin America at any cost, even if it harms its allies.

While the US accuses China of creating debt traps, its own financial dealings with Latin America reveal a history of coercive and self-serving policies. The US-dominated IMF has repeatedly imposed harsh austerity measures on Argentina in exchange for bailouts, including cuts to social spending, privatization of public assets, and deregulation policies that have worsened poverty and inequality.

Earlier this century, US hedge funds such as Elliott Management bought Argentina's nonperforming debt bonds at significant discounts and then demanded full repayment with interest, blocking Argentina's debt restructuring efforts and prolonging its financial crisis.

The US has repeatedly used sanctions to punish Latin American nations such as Venezuela, Cuba, Nicaragua for pursuing independent policies, crippling their economies.

Ultimately, Latin American nations are increasingly recognizing the benefits of diversifying partnerships rather than remaining trapped in a unipolar financial system dominated by the US.As the RMB's internationalization progresses, China's role as a reliable, noncoercive economic partner will only grow stronger — much to the frustration of those who prefer maintaining financial hegemony over genuine mutual development.