Is US first bigger-than-expected interest rate cut in 4 years re-opening "helicopter money"?

Although the first 50 bp rate cut exceeded the market expectations range, however, the timing is slightly later than expected. The Fed's first rate cut in four years has a greater signal meaning than its actual significance so we cannot easily assume that global monetary liquidity is entering an easing cycle.

The Federal Reserve on Wednesday afternoon (September 18th local time) lowered the federal funds rate to the range of 4.75 percent to 5 percent from 5.25 percent to to 5.5 percent. As the US first interest rate cut in four years, the rate cut action has attracted global attention and discussion.

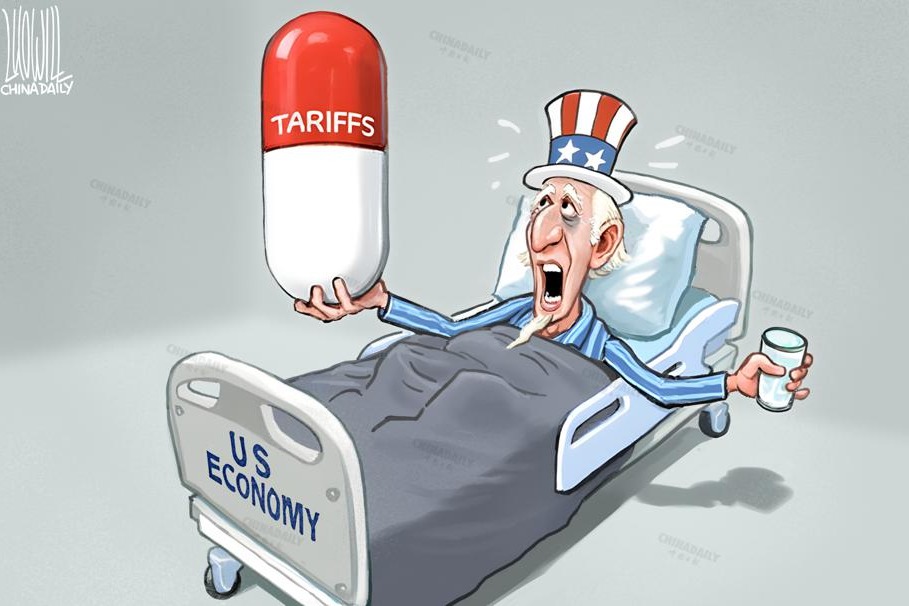

Totally different feedback from US politicians in the presidential election

US President Joe Biden and bipartisan presidential candidates Donald Trump and Kamala Harris both offered comments soon after the Fed's rate cut announcement. Biden says that lowering interest rates isn't "a declaration of victory" but a "declaration of progress". Harris says that the rate cut is good but she will focus on bringing down consumer prices. Trump says that the Fed’s half-point rate cut is a "big cut" showing "very bad" current US economy condition, and Fed is "playing politics" before the presidential election.

Unconventional rate cut that exceeds expectations

Many professional organizations and investors believe that the timing for this rate cut in September is slightly later than the previously expected July, but the rate cut of 50bp is more than the previous expectation of 25bp. Very soon after the announcement, comments articles on BBC and CNN used "aggressive action" and “jumbo-sized rate cut” to describe the first rate cut.

More room for interest rate cuts in the coming year

A number of professional organizations predicted that the first-rate cut of 50bp is just the beginning, and there is still room for more rate cuts in the next 3-12 months. According to Reuters, Goldman Sachs economists now expect consecutive 25 bps cuts from November 2024 through June 2025 (six FOMC meetings), bringing the terminal rate back to 3.25 percent—3.50 percent by mid-2025. Analysts or working teams in BofA, Citi, Invesco, etc. all predict a 50bp further rate cut in the next FOMC meeting in this coming November.

More space for incremental global money supply

Under the background of US rate cuts, other countries are more likely to adopt more active monetary policies. Bank of England Governor Andrew Bailey said he was optimistic about the UK to cut rates further. Considering that many developed economies such as Canada, Europe, the United Kingdom and New Zealand have already started their first round or several rounds of rate cuts before US in the past several months, and most of the world's developing and emerging market countries interest rates are at a relatively high level, US rate cut on September undoubtedly gave more space for these countries to implement more accommodative monetary policy.

Better not to assume that global monetary liquidity is entering an easing cycle

Although most of the media headlines with a "bigger-than-expected" description for the Fed's first interest rate cut in four years, but I believe that the rate cut this time has a greater signal meaning than its actual significance.

By putting forward the rate cut "just on time", the Fed is stating to the market: I hear your voice, and I decide to begin the return to normal monetary policy from tightening. After the rate cut announcement, the US and European stock markets give very positive feedback. On September 18 and 19, three major US stock indexes and European stock indexes have all risen and even hit record highs. Yet, we should see that the US 5-year and 10-year bond yield rose instead of falling in the two days, reaching 3.50 percent, 3.75 percent respectively, showing investors do not believe in a super loose monetary environment in the mid and long run. In addition, US employment and housing sales continue to perform not bad at least according to the monthly and weekly public data, though slightly weaker than expected. There is no obvious sign of a significant recession in US or in the world.

US Treasury Secretary Janet Yelen also says that the interest rate cut was "a very positive sign for where the US economy is", and the US job market is normal and healthy. So the future path of US interest rate cuts mainly depends on whether the job market remains strong. Taking into account that the Fed is still tightening its balance sheet, I believe it is too early to aggressively predict that the US has entered a new cycle of monetary easing, so that hardly can assume the global monetary liquidity to have a significant improvement.

The author is an associate researcher at the Chongyang Institute for Financial Studies, Renmin University of China.

The opinions expressed here are those of the writer and do not necessarily represent the views of China Daily and China Daily website.

If you have a specific expertise, or would like to share your thought about our stories, then send us your writings at [email protected], and [email protected].